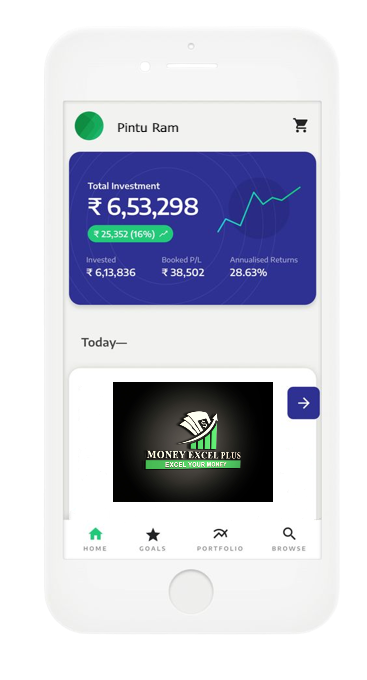

We At Money Excel Plus

our company “Money Excel Plus” run from Jan2021 but the owner of the company Mr Pintu Ram having experience of 17yrs in financial market. The educational background is commerce with PGDBM of dual specialization Marketing and Finance. We have a vital experience of financial product like Mutual Fund, Stock Broking, Life Insurance, General Insurance, crypto market, US stock treading, Bond, taxation, Life and General insurance also etc. We manage more than 500 customer in different financial product. We are associated with all mutual fund AMC . Our aim is to provide a complete range of financial solution under one roof. The range includes a complete combination of best of breed proprietary and non proprietary product. Our approach is to recommend such types of product which suits your need and goal. We feel your money is our liabilities and invest such a manner where as your get a maximum return of profit with protection of capital.

Our aim is to provide all types of finance solution under one roof. So we provide all types of finance & investment services like : Mutual Fund, SIP, Life Insurance, Health Insurance, Income tax, GST, Digital Signature, all types of loan Personal Loan, Business Loan, Home Loan, Auto Loan, Motor insurance etc.

Mutual Fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe and open-ended investment company in the UK. A mutual fund is an investment vehicle where multiple investors come together and pool their funds. This pooled money is then invested by the fund manager across various asset classes including equity, debt, gold, and other securities to generate returns.

What Is the Average Mutual Fund Return?

Potential Annual Returns When You Invest in Mutual Funds

If you want to invest in mutual funds, you may want to get a sense of the average return before making any moves with your money. Looking back at the most recent annual returns on mutual funds in broad categories like large-cap stocks or long-term bonds may help you better understand where you want to invest your money. Here's a breakdown and what you need to know as you assess your options.

Look at Long-Term Returns on Mutual Funds

Although past performance is no guarantee of future results, historical returns can provide reasonable expectations about the growth of an investment over time.

For example, in 2021, mutual funds in seven broad categories averaged an annual return of 11.54% (see the table below), well above the average annual return over the 15 years prior to that. U.S. large-cap stock funds were the best performing category of the seven, while short-term bond funds were the worst. You can also look at performance since inception. For example, the Vanguard 500 Index Investor had a 10-year return of 15.46% as of Dec. 31, 2021, while its average return since its inception in 2004 as of that same date was 11.66%.12 One of the more reliable gauges of future performance is the average annual return over a past 15-year period. Short-term performance can vary widely, so even looking at a past 10-year period may not capture the full picture for you. For example, the 10-year annualized return of the S&P 500 Index as of Jan. 18, 2022, was about 13.34%.3 But the 15-year annualized return as of that same date was 8.08%.4 Through the end of 2022, a 15-year figure is a more realistic predictor of future performance because it includes the bear market of 2008. Once it's 2023, the bear market of 2008 will no longer be part of the 15-year figure.

Choose a Benchmark

Since there are many different types of mutual funds, it's best to make apples-to-apples comparisons with a suitable benchmark. For example, to measure a large-cap stock mutual fund, you can use the S&P 500 as a benchmark because it reflects 500 of the largest U.S. companies.

Another benchmark is the average performance for a particular category of mutual funds. A large-cap stock fund with a growth objective would be categorized as a Large Growth fund. Category returns are more reflective of actual results because the returns factor in the expense ratios—how much an investor pays for the operation of the fund. Indexes, on the other hand, do not reflect expenses.

Features

Check The Features

Gallery

Check our Gallery

Fact Finding

Fact Finding

(Become your own Boss)HLV calculate in four steps:

Steps 1 – Determine your current income

Steps 2 – Subtract your expenses (Like – insurance premium and income

tax payment)

Steps 3 – Identify the number of earning years remaining before your

retirement

Steps 4 – Find the inflection and discounting factor rate.

Contact

Contact Us

Location:

GB-14, First Floor, City Center, Sec- 4, Opposite Union Bank main branch, Bokaro Steel City, Jharkhand -827004

Email:

Call:

+91 9304830231